For more information, see the official site: github.io

Contents

Initialize session with Trader Workstation

% initialize session with TWS session = TWS.Session.getInstance(); % create local buffer for historical data events [buf,lh] = TWS.initBufferForEvent(TWS.Events.HISTORICALDATA); % connect to TWS session.eClientSocket.eConnect('127.0.0.1',7496,0);

added interface method: TWSNotification notification listener has been added Server Version:71 TWS Time at connection:20141231 09:54:40 EST

Requesting historical data from IB/TWS

% create an empty stock contract contract = com.tws.ContractFactory.GenericStockContract('FB'); % request historical data for our contract for a year w/ 1-day bars session.eClientSocket.reqHistoricalData(1000001,contract,'20141230 16:00:00','1 Y','1 day','TRADES',1,1,false,[]); pause(0.5);

Process historical data event

Under the hood, Trader Workstation returns one bar at a time. That is, EWrapper:historicalData() is called once for each bar. Each bar associated with the request ID, 1000001 in this case, is aggregated into a single event (i.e. event.data = HashSet<com.tws.Bar>)

Retreive the historical data event from the buffer

hde = buf.get();

Convert the HashSet<Bar> into more native cell array of bars

bars = collection2cell(hde.data);

Figure out how many bars were returned

numel(bars)

ans = 252

but could also call size() method on event.data directly without cell conversion

numel(bars) == hde.data.size()

ans =

1

Print out bars to the screen

for i = 1:min(numel(bars),10); disp(bars{i}); end

1000001 20141107 12:00:00 75.39 75.86 75.02 75.60 177169 80295 1000001 20140102 12:00:00 54.83 55.22 54.19 54.71 428839 159633 1000001 20140228 12:00:00 69.31 69.88 67.38 68.46 593817 210923 1000001 20140724 12:00:00 76.00 76.74 74.51 74.98 1055827 373253 1000001 20141024 12:00:00 80.10 80.76 79.32 80.67 272171 122810 1000001 20141208 12:00:00 76.18 77.25 75.40 76.52 230905 108425 1000001 20140227 12:00:00 69.34 70.01 68.87 68.94 377375 142062 1000001 20140415 12:00:00 59.29 59.68 55.88 59.09 1032015 348145 1000001 20141027 12:00:00 80.74 80.80 79.76 80.28 252252 116477 1000001 20141229 12:00:00 80.56 80.96 79.71 80.02 124733 61079

Extract close and volume info from each bar

close = cellfun(@(b)b.close,bars); vol = cellfun(@(b)b.volume,bars);

Convert the string time of the bars to matlab datenum

dt = datenum(cellfun(@(b)char(b.dtstr),bars,'UniformOutput',false),'yyyymmdd HH:MM:SS');

The bars might not be in order once extracted from the HashSet

[~,indx] = sort(dt);

Now, finally, plot the data

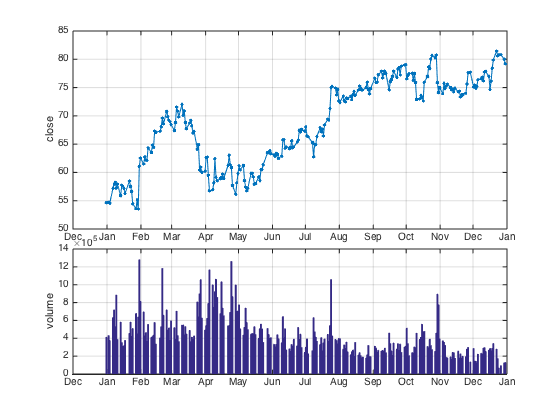

subplot(5,1,1:3); plot(dt(indx),close(indx),'Marker','.'); xlim([min(dt),max(dt)]); datetick; grid on; ylabel('close' ); subplot(5,1,4:5); bar (dt(indx),vol (indx) ); xlim([min(dt),max(dt)]); datetick; grid on; ylabel('volume');

From here, it is easy to move on to candel plots and other technical indicators etc.

See Also

candle | highlow | bolling | movavg

References

Mathworks Financial Toolbox:

Matlab File Exchange:

Interactive Brokers API:

TWS@Github:

Apache Commons:

Java Docs: